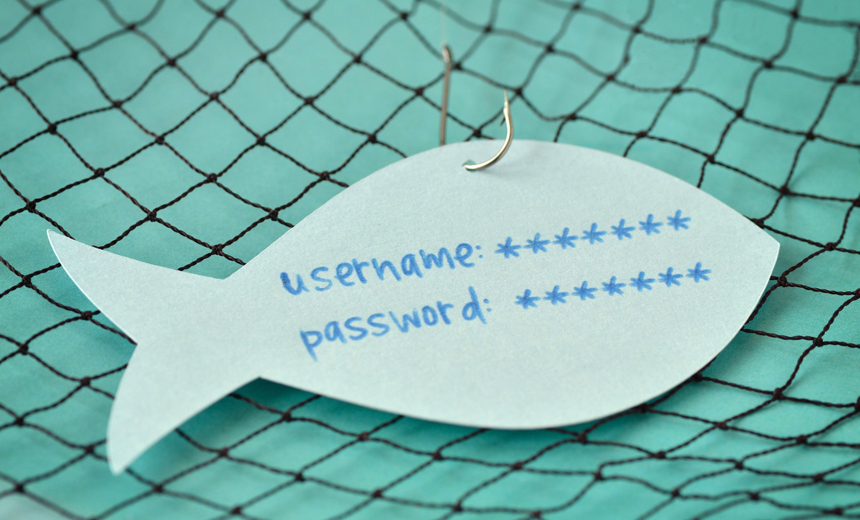

The Vulnerabilities of Traditional Identity Verification

As account opening continues to transition from physical to digital channels, financial institutions and other organizations must optimize the digital experience of applicants in order to compete. At the same time, fraud is on the rise thanks to some of the same digital channel benefits enjoyed by consumers: convenience, speed, and ease of use.

To achieve the necessary balance between preventing fraud and providing a positive user experience, an identity proofing strategy accounting for the channel, product, customer, and threat environment is absolutely critical. Inconspicuous solutions - like those based on applicant behavior - have a distinct role in how institutions manage application fraud risks.

Download this whitepaper to learn about:

- Vulnerabilities that are inherent in traditional identity verification;

- The role behavior plays in identity proofing and ways to implement a strategy;

- Identify risks beyond financial services.